Getting Paid

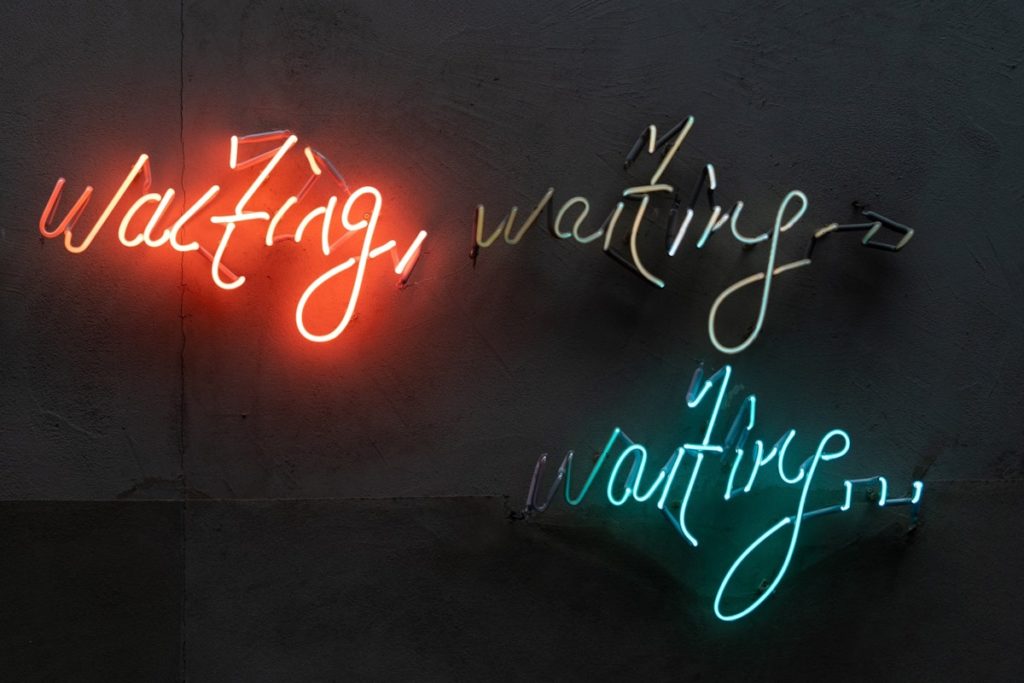

Are you waiting for payments? Are your customers paying you on time? We’ve got 5 simple tips for speeding up payments and giving your cashflow position a boost.

Cashflow Forecasting to put you back in control

Cash is the lifeblood of any business; even profitable businesses can fail because of poor cashflow. We’ll help you set up detailed cashflow forecasting to put you back in the cashflow driving seat.

Tips to get your financial year end work completed faster

Getting your financial end of year work done now will give you accurate data to make informed business decisions. Get your end-of-financial-year work done now so you can focus on your business.

End of financial year checklist

It’s end of financial year – time to start thinking about your annual accounts. What do you need to pull together so we can get it right and help your business succeed? Our end-of-year checklist will help.

Responsive advice and reporting for NZ’s leading independent content company

“Not only do we get a really quick turnaround when we need it, but Traktion have taken the time to really understand us. They’re not just ticking the boxes. The service we get is personalised and they’re always looking for ways to improve our business.”

Kiriana Burke, Pango

Cash Flow Forecasting: Prepare to Rock Your Finances!

Get ready to cash in on forecasting! Trust us, your business will thank you. By understanding your revenue and costs, you’ll have all the power to take action when the time is just right.

A guide to income tax for business owners

We’ve built this article around the questions we frequently get from new business owners. Scroll down, or feel free to jump straight to the one on your mind! What is provisional tax? The moment it’s anticipated that you’ll pay more than $5,000 in tax per year, you enter the IRD’s provisional tax regime. Provisional tax […]

Profit ≠ bank account balance

Did you know that cash and profit aren’t always the same thing? Let’s explore the reasons why they may not perfectly align.

Paying Tax (or Not)

Paying your fair share of tax is required by law, but paying too much is unnecessary.

When does Inland Revenue charge penalties and interest?

You may be wondering if, why, and when the IRD charges interest and penalties. Well, they do have a method to what appears to be madness! Late filing penalties Penalties paid to the IRD cannot be claimed as business expenses. Penalties can be charged on all tax types except Student Loans. The penalty will range […]